Workseer's Trade import management ensures that importing products and goods critical to your operations is done with maximum efficiency and compliance. Our comprehensive trade import solution provides several key benefits, enabling you to maintain, control, and manage all aspects of the import process effectively.

A well-implemented trade import management solution is crucial for businesses relying on imported goods. Workseer ensures efficiency, compliance, and cost-effectiveness by centralizing information, automating compliance checks, managing documentation, and providing real-time visibility into the import process. By leveraging these capabilities, companies can streamline their operations, reduce risks, and enhance their overall supply chain performance. Here's an in-depth look at how trade import management can streamline and enhance your operations:

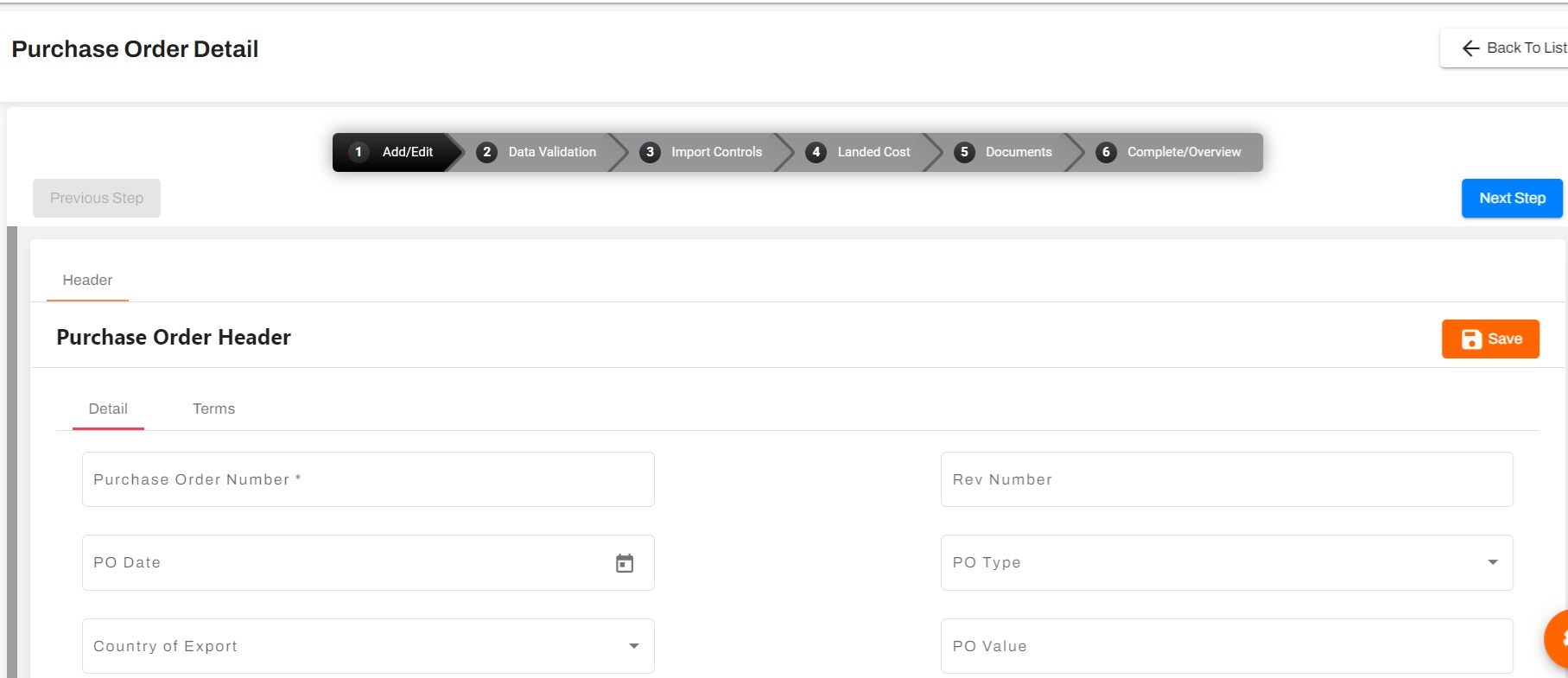

Purchase Order Screening : Workseer ensures that all purchase orders comply with relevant trade regulations and internal policies before proceeding with further processing. It verifies the products, suppliers, and destinations comply with local and international regulations, including embargoes and sanctioned party lists. It performs the import controls checks and calculates the landed cost.

Workseer ensures that all necessary information is accurately recorded in the purchase order, including product descriptions, quantities, and HS codes. A configurable data validation option enables customers to configure additional data validation on some critical data elements that is important to them.

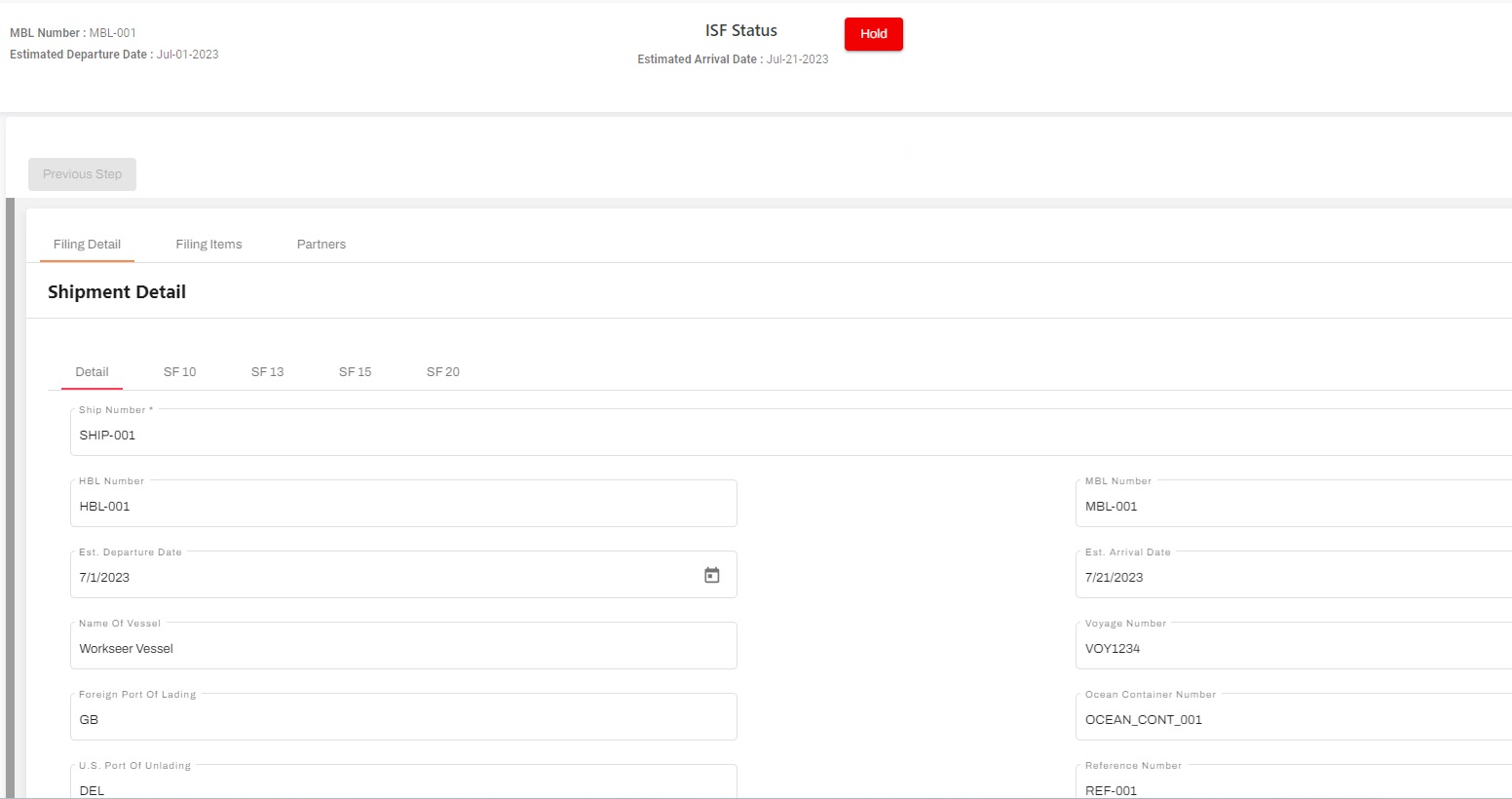

Import Security Filings (ISF) : The Importer Security Filing (ISF), commonly known as "10+2," is a crucial requirement for ocean cargo imported into the United States. This regulation mandates the submission of specific data elements to the U.S. Customs and Border Protection (CBP) before the cargo is loaded onto vessels bound for the U.S. The objective is to enhance security by identifying high-risk shipments and ensuring compliance with import regulations.

By adhering to the ISF 10+2 requirements and leveraging advanced Workseer's import management solution, importers can ensure compliance, enhance security, and streamline their import operations for greater efficiency and cost-effectiveness.

Enhanced Security: Helps CBP identify high-risk shipments before they reach the U.S., improving national security.

Streamlined Processes : Facilitates smoother and quicker customs clearance processes by ensuring all required information is available beforehand.

Avoidance of Penalties: Compliance with ISF 10+2 regulations helps avoid fines and penalties associated with late or inaccurate filings.

Improved Supply Chain Visibility: Provides better visibility and control over the supply chain, enabling more efficient logistics planning and management.

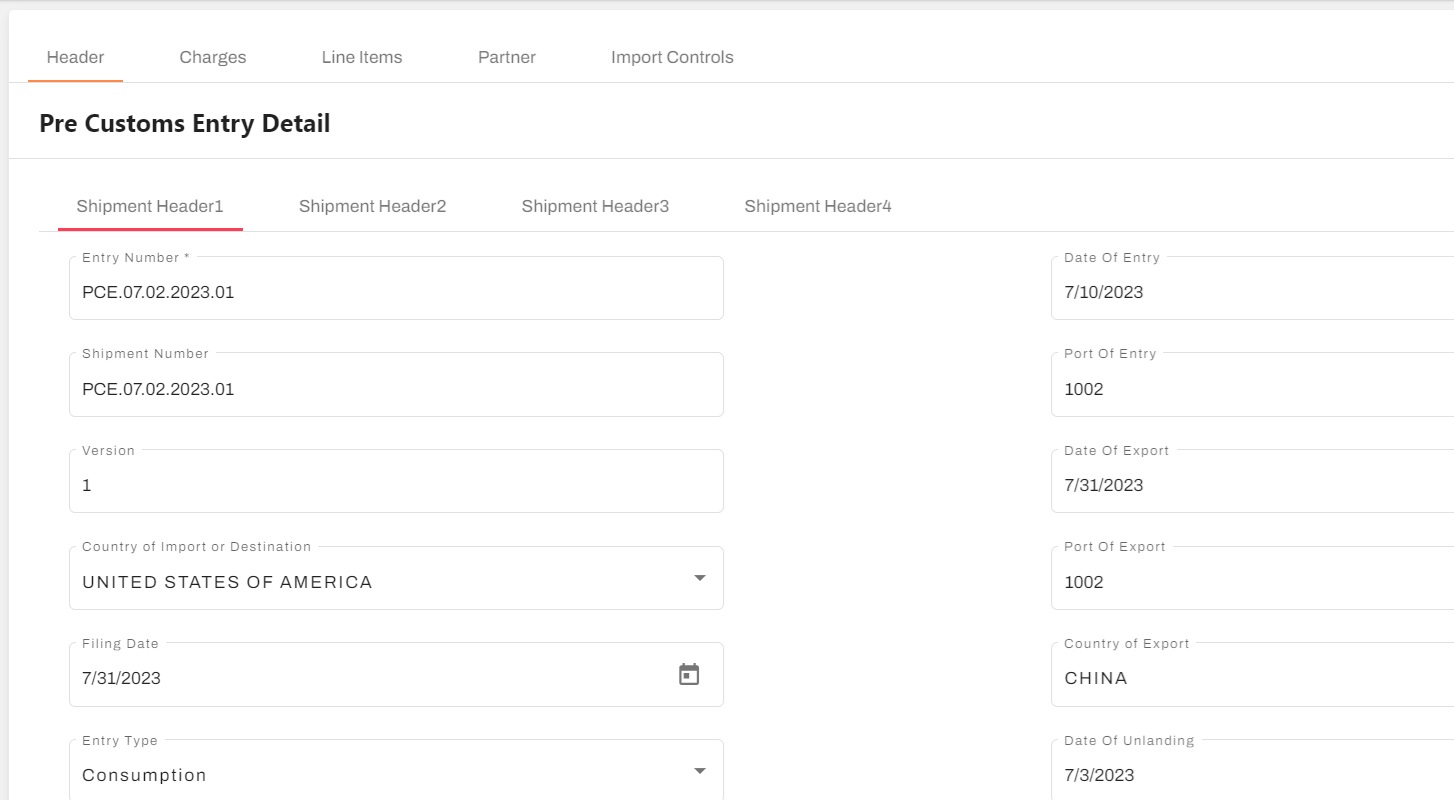

Pre-Customs Entry : Workseer enables users to prepare and validate all necessary documentation and data before submitting them to customs authorities for clearance.

Data Assembly: Compile data from purchase orders, shipment notifications, and commercial invoices into a pre-customs entry packet

Compliance Verification: Perform thorough checks to ensure that all data complies with import regulations and trade agreements.

Import Control Determination: Conduct import control checks to revalidate compliance before data submission.

Landed Cost Calculation: Calculates the duties & taxes based on the HS for the importing country and ultimately provides the Landed Cost.

Document Preparation: Generate all required documents, such as commercial invoices, packing lists, and certificates of origin.

Audit Trails: Maintain detailed records of all changes and validations, ensuring traceability and accountability

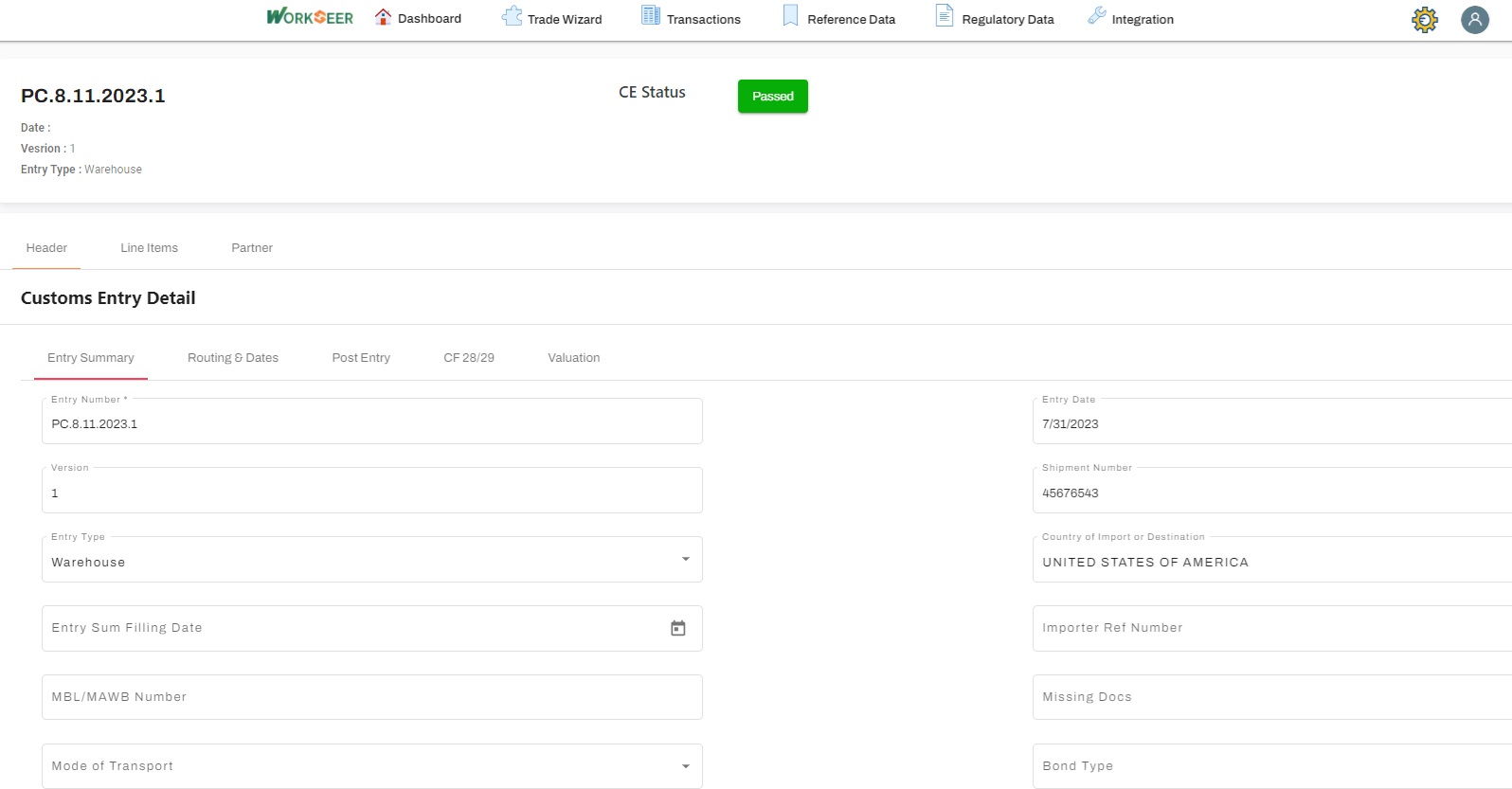

Customs Entry : Submit all required documentation and data to customs authorities for the official import clearance process.

Data Submission: Send the pre-customs entry packet, along with any additional required documentation, to customs authorities or brokers.

Broker Coordination: Work with customs brokers to ensure accurate and timely submission of customs entries.

Self-Filing: Accurately perform self-filing through Workseer's CBP certified customs filing interface.

Real-Time Tracking: Monitor the status of the customs entry process to promptly address any issues or requests from customs authorities.

Compliance Assurance: Ensure that all submitted data is accurate and complete to avoid delays and penalties.

Post-Entry : Finalize the import process by addressing any discrepancies, completing necessary filings, and ensuring compliance.

Reconciliation Entry (Type 09): This is a post-entry filing that permits the importer to reconcile or correct, filed entry data without penalty for a period of 12 to 15 months after release of the goods. The importer must be approved for this program and post a special surety bond rider for specific pre-established corrections i.e. valuation or classification

Post Entry Amendment (PEA) : This is another program that essentially tries to devise a uniform and less punitive method of correcting errors identified after the initial entry processing.

Variance Reports: Generate reports to identify any discrepancies between the data submitted and the data filed by brokers.

Discrepancy Resolution: Investigate and resolve any discrepancies or issues identified in variance reports.

Final Compliance Checks: Perform a final review to ensure that all regulatory requirements have been met and all documentation is complete.

Record Keeping: Maintain comprehensive records of all import transactions for future reference and audits.

Post-Entry Audits: Conduct internal audits to verify compliance and identify areas for improvement in the import process.

Product Master File : Workseer's Import Product Master File is a crucial element in managing import operations effectively. It serves as a comprehensive, centralized repository for all product-related information required for import documentation and classification, ensuring consistency and compliance across different ports of entry, shippers, and U.S. Customhouse brokers. Here's an in-depth look at the components, functionalities, and benefits of maintaining a robust Trade Import Product Master File:

Consistency and Standardization: It ensures uniformity in import documentation and classification regardless of the port of entry, shipper, or broker involved. It reduces errors and discrepancies in import processes.

Compliance Management : It provides tools to manage compliance with international trade regulations, including automated checks and alerts for potential issues. It maintains accurate HS codes and country of origin information to ensure correct duty assessments and compliance with trade agreements.

Control Mechanisms: Internal control flags (Hold, Warning, Override) in Workseer oriduct master file help manage and flag products that may require special attention or action. A full audit trail tracks all changes and decisions, providing transparency and accountability.

Data Integration and Automation: Accepts data electronically from legacy systems, ensuring seamless integration and consistency of information. Automates the updating and maintenance of product information to reduce manual errors and save time.

Enhanced Compliance: Automated checks and validations ensure adherence to all relevant regulations and reduce the risk of penalties.

Improved Efficiency: Streamlined processes reduce manual effort, minimize delays, and enhance the overall efficiency of import operations.

Cost Savings: Accurate duty and tax calculations, along with effective risk management, help control costs and prevent unexpected expenses.

Greater Visibility: Comprehensive tracking and reporting provide better visibility into the import process, facilitating proactive management and decision-making.

Audit Readiness: Detailed audit trails and record-keeping ensure that the organization is always prepared for internal and external audits.